New experience

How to find cheap car insurance

This website is dedicated to teaching you everything you need to know to find the cheapest car insurance

Compare Car Insurance Quotes

Shopping around and getting quotes from multiple car insurance providers is a great way to find the best rates. Be sure to compare apples to apples by requesting quotes for the same coverage levels and deductibles from each provider.

Look for Car Insurance Discounts

Many insurance companies offer discounts for safe driving, multiple vehicles, good grades, and other factors. Be sure to ask about available discounts when getting quotes.

Car Insurance Coverage Needs

While it may be tempting to choose the minimum coverage required by law, it’s important to consider your coverage needs and any potential risks. Make sure you have enough coverage to protect yourself and your assets in the event of an accident or other incident.

Here are the three most important factors when finding cheap car insurance

By considering these three factors, you can make informed decisions about your car insurance coverage and find affordable options that meet your needs.

01

Car Insurance Coverage Limits

The amount of coverage you choose for your car insurance can have a significant impact on the cost of your policy. While it may be tempting to choose the minimum coverage required by law, it’s important to make sure you have enough coverage to protect yourself in the event of an accident. Consider your assets and financial situation when choosing your coverage limits.

02

Car Insurance Deductible Amount

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your monthly premiums, but it’s important to make sure you can afford the deductible in the event of an accident.

03

Your Driving History

Your driving record can also affect the cost of your car insurance. Drivers with a history of accidents or traffic violations may be considered higher risk and may have to pay higher premiums. On the other hand, drivers with a clean record may be eligible for discounts and lower rates.

See what people have to say about us

Leslie Alexander

Web designer

Highly recommended!

I can’t believe how much money I saved on my car insurance! Kenny helped me find a great deal that fits my budget.

Jacob Jones

Freelancer

Endless Shopping

I was dreading the thought of shopping around for car insurance, but Kenny made the process so easy and stress-free.

Darlene Robertson

Business owner

Easy to use

Thanks to Kenny’s help, I was able to find an affordable car insurance policy with great coverage. I feel so much more secure knowing that I’m protected on the road.

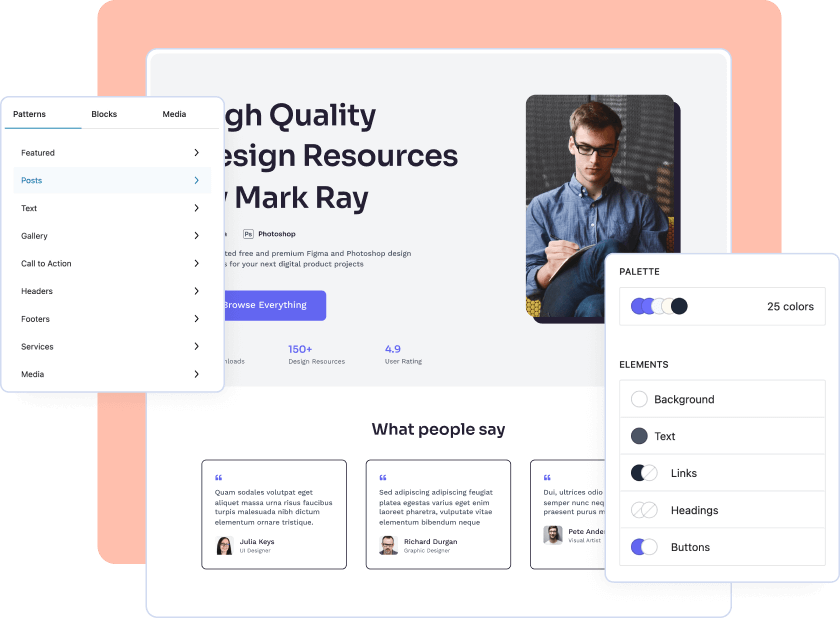

Brought to you by the creators of

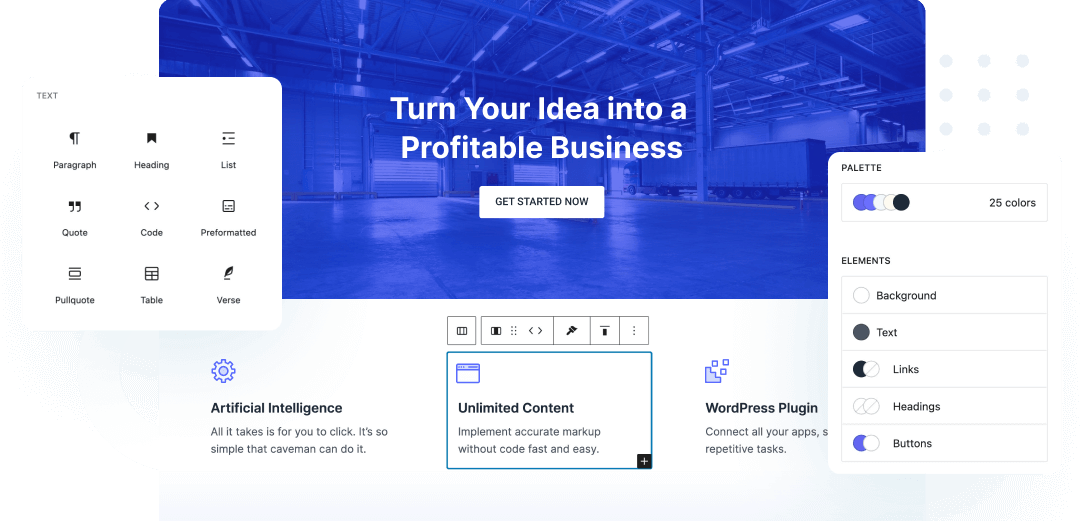

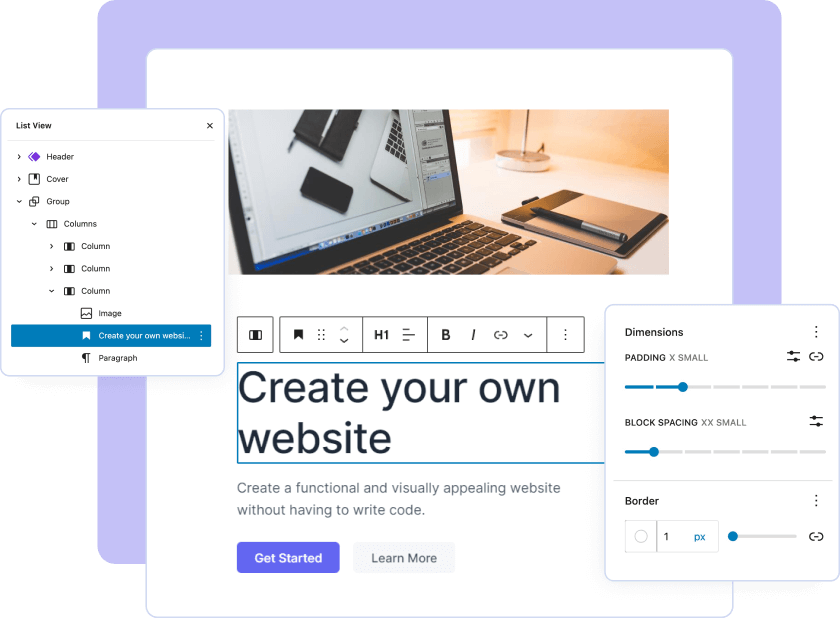

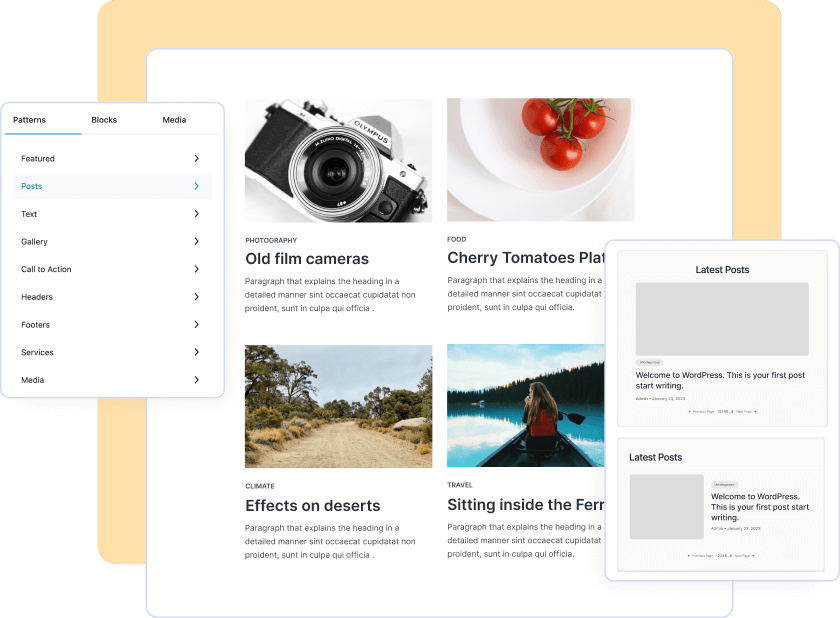

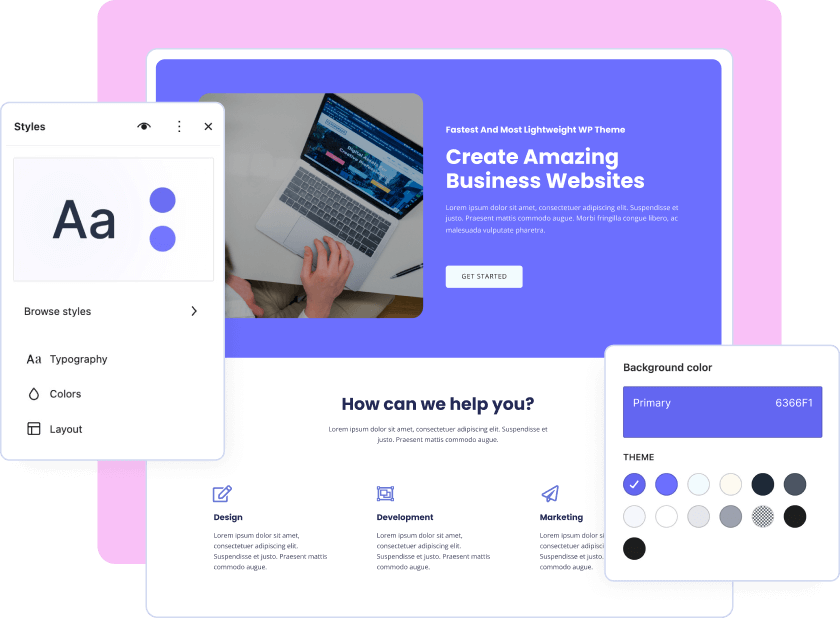

Everything you need to create amazing websites

Interactive design tools and its many customization options to customize anything and everything needed to build the fully-functional website of your dreams.

Latest from The Cheap Car Insurance Blog

Frequently Asked Questions

How can I find the cheapest car insurance rates?

The best way to find the cheapest car insurance rates is to shop around and get quotes from multiple insurance providers. Comparing quotes and asking about available discounts can help you find the best rates.

What factors affect my car insurance rates?

Several factors can affect your car insurance rates, including your driving record, age, location, type of vehicle, and coverage needs. Be sure to provide accurate information when getting quotes to ensure that you receive accurate rates.

Should I choose the minimum coverage required by law to save money on car insurance?

While choosing the minimum coverage required by law may save you money on your car insurance premiums, it’s important to consider your coverage needs and potential risks. Choosing too little coverage can leave you vulnerable in the event of an accident or other incident.

Can I still get affordable car insurance if I have a less-than-perfect driving record?

Yes, it’s still possible to get affordable car insurance with a less-than-perfect driving record. Be sure to shop around and ask about available discounts for safe driving, taking defensive driving courses, and other factors. Additionally, consider raising your deductibles or adjusting your coverage levels to find more affordable rates.

Find Cheap Car Insurance Near You Now

Click here to get free cheap car insurance quotes